Conveyancing Unpacked: A Guide For First-Time Buyers

Buying your first home is an exciting milestone, but navigating the legal process can feel overwhelming – especially when you encounter unfamiliar terms like “conveyancing”. At Almy & Thomas, we understand how overwhelming it can feel to navigate the legal complexities of property buying, so we’ve created this guide to help you every step of the way.

With over 100 years of experience providing expert legal services in Torquay, our team of specialist solicitors has helped countless first-time buyers achieve their dream of homeownership. In this guide, we’ll explain what conveyancing involves, what fees to expect, and why working with a solicitor can make all the difference.

What Is Conveyancing?

Conveyancing refers to the legal and administrative process involved in transferring ownership of a property from one person to another. It’s a vital step in protecting your investment and ensuring a smooth purchase. Without conveyancing, you could risk buying a property with hidden legal issues or complications.

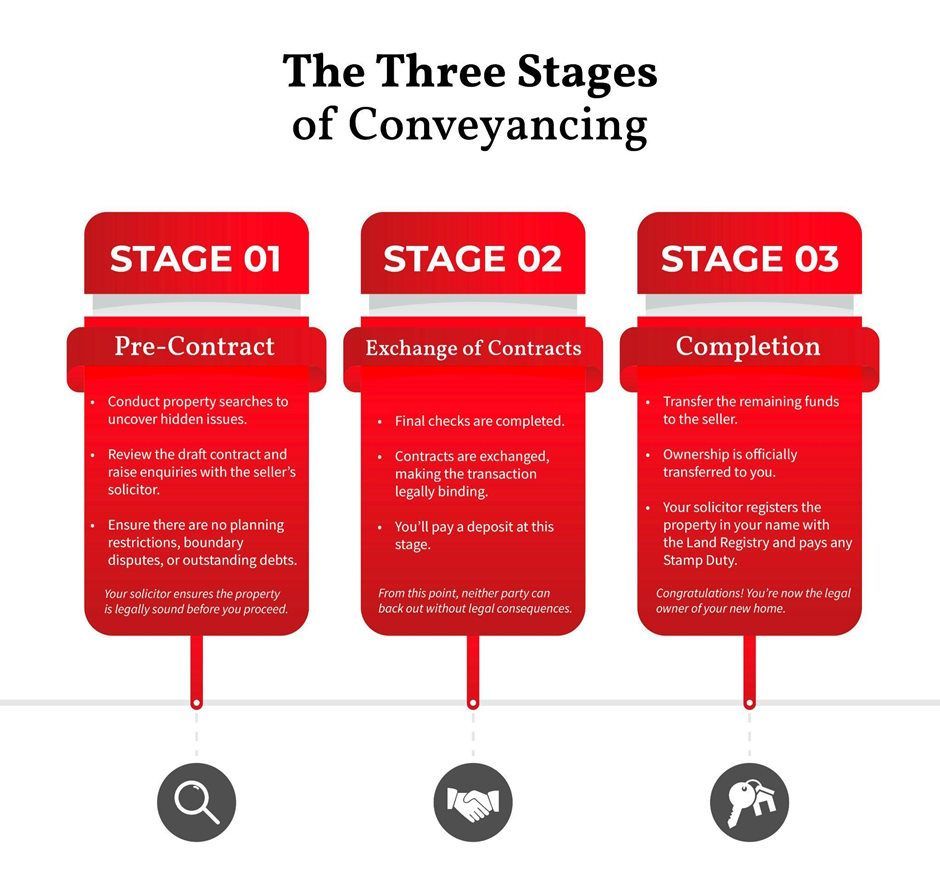

This process can be broken down into three key stages:

Pre-Contract

● Your solicitor conducts property searches, reviews the draft contract, and raises enquiries with the seller’s legal representative.

● This stage ensures there are no hidden issues, such as planning restrictions, boundary disputes, or outstanding debts tied to the property.

Exchange of Contracts

● Once all checks are complete, contracts are exchanged between the buyer and seller.

● At this point, the transaction becomes legally binding, and you’ll need to pay a deposit.

Completion

● On completion day, the remaining funds are transferred, and ownership is officially transferred to you.

● Your solicitor will register the property in your name with the Land Registry and pay any required Stamp Duty.

Conveyancing is a critical part of the home-buying process, and having an experienced solicitor on your side can make all the difference.

Why Choose a Solicitor for Your Conveyancing Needs?

When embarking on your property purchase, you need a legal professional who can handle the complexities of the process while providing peace of mind. At Almy & Thomas, our solicitors go above and beyond to deliver expert guidance tailored to your unique circumstances.

Why Work With a Solicitor?

Solicitors are trained to handle not just straightforward transactions but also the unexpected challenges that can arise during the conveyancing process. This is particularly important for first-time buyers who may encounter:

● Complications with leasehold properties.

● Issues identified in property searches, such as restrictive covenants.

● Additional legal needs, such as joint ownership agreements or inheritance considerations.

The Almy & Thomas Difference

At Almy & Thomas, our team of solicitors combines specialist knowledge with a personalised approach. We take the time to understand your specific needs and ensure that every detail of your transaction is handled with precision.

By choosing us, you’ll benefit from:

Comprehensive Expertise: We bring decades of experience to property transactions of all kinds.

Transparent Pricing: Our clear, upfront quotes ensure you know exactly what to expect, with no hidden fees.

Tailored Support: We’re here to guide you through the process, answering any questions and keeping you informed at every stage.

When it comes to protecting your investment, our solicitors are your trusted partners for a seamless and stress-free experience.

Understanding Conveyancing Fees

For many first-time buyers, conveyancing fees can feel like an unexpected and confusing expense. However, understanding what these costs cover and how they’re calculated can help you budget effectively and avoid surprises. At Almy & Thomas, we believe in complete transparency when it comes to our costs, ensuring you know exactly what you’re paying for.

What Do Conveyancing Fees Cover?

Conveyancing fees are divided into two main components: professional fees and disbursements. Here’s a breakdown of what each involves:

Professional Fees

These fees cover the expertise and time of your solicitor. They include tasks such as:

● Reviewing contracts and documentation.

● Conducting due diligence, such as raising enquiries with the seller’s solicitor.

● Advising you on legal matters and ensuring the property is free from risks or encumbrances.

● Preparing the paperwork needed to finalise the purchase, including arranging for funds to be transferred.

At Almy & Thomas, our professional fees are always explained clearly in advance. Depending on your case, we may offer fixed-fee pricing, an hourly rate, or a bespoke arrangement tailored to your needs. All fees are outlined in your client care letter to ensure there are no surprises.

Disbursements

These are third-party costs that your solicitor handles on your behalf, including:

Searches: Local authority, environmental, and water searches to uncover risks or restrictions affecting the property.

Land Registry Fees: Fees for registering your ownership of the property.

Stamp Duty Land Tax: A government tax applicable to properties above a certain threshold.

Bank Transfer Fees: Secure transfer of funds.

Additional Charges

While we strive to provide an accurate estimate at the outset, some factors – such as complex leaseholds, shared ownership, or unforeseen legal issues – may lead to additional fees. For example:

Leasehold Properties: Leaseholds often require additional enquiries to clarify obligations, service charges, and ground rents.

Help-to-Buy or Shared Ownership Schemes: These involve extra paperwork and legal checks to ensure compliance with the scheme’s requirements.

Indemnity Insurance: If any issues arise that can’t be resolved through searches, indemnity insurance might be required to protect you from future legal or financial risks.

Rest assured, we keep our clients informed of any potential additional fees throughout the process, updating charges as needed.

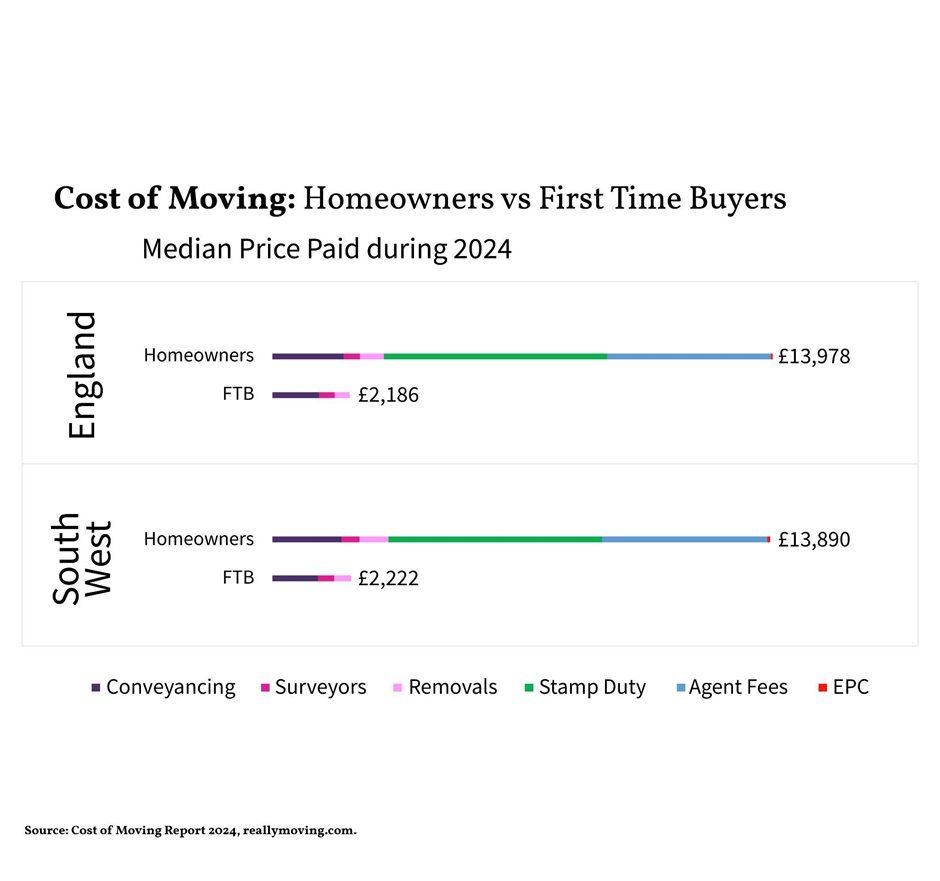

To give you an initial idea of what to expect, the graph below compares the median costs of moving for homeowners and first-time buyers (FTBs) across England and in the South West specifically. Expenses are broken down into six categories: Conveyancing, Surveyors, Removals, Stamp Duty, Agent Fees, and EPC (Energy Performance Certificate).

Fee Structures Tailored to Your Unique Circumstances

At Almy & Thomas, we understand that every client’s situation is unique, which is why we offer a variety of funding options depending on the nature of your case. These include:

Fixed Fees: A clear, upfront cost for straightforward transactions.

Hourly Rates: For more complex cases where work required may vary.

No Win, No Fee Agreements: In some cases, where applicable.

Damages-Based Agreements: Depending on the type of claim or case.

We provide all our clients with a best estimate of fees at the start of the process and review charges regularly to ensure they remain accurate and reasonable. You’ll always know where you stand, as we believe transparency is key to building trust.

Factors That Affect Costs

The total cost of conveyancing can vary significantly depending on several factors, including:

Property Value: Higher-value properties often attract higher fees, both in terms of professional charges and disbursements such as Stamp Duty Land Tax.

Freehold vs. Leasehold: Leasehold properties typically involve more work, as your solicitor will need to review the lease and check for associated costs like service charges, ground rents, and lease terms.

Property Location: Conveyancing fees may vary depending on the property’s location, as some regions have additional search requirements or higher Land Registry fees.

Transaction Complexity: If there are any legal complications, such as boundary disputes or unclear ownership, these can increase the time and work required to complete the process.

Our Tips for First-Time Buyers

Buying your first home doesn’t have to be stressful. With the right preparation and support, the process can be smooth and enjoyable. Here are some tips to help you get started:

Instruct a Solicitor Early: Don’t wait until the last minute. Instruct a solicitor as soon as your offer is accepted to avoid unnecessary delays.

Stay Organised: Respond promptly to requests for documents or information from your solicitor.

Ask Questions: Don’t hesitate to ask if you’re unsure about any part of the process. Your solicitor is there to help.

Budget for Extras: Set aside some additional funds for unexpected costs, such as extra searches or surveys.

Work With a Trusted Solicitor: Choosing an experienced solicitors firm like Almy & Thomas ensures your transaction is in safe hands.

Why Choose Almy & Thomas?

At Almy & Thomas, we understand the challenges that first-time buyers face, and we’re here to make your property purchase as seamless as possible.

With a history spanning over 100 years, we’ve built a reputation for excellence and client satisfaction. Our team of licensed conveyancers in Torquay is committed to providing professional, reliable, and personalised service. Whether you’re simply looking to buy your first home or navigating specific challenging circumstances, we’ll guide you through every stage with care and expertise.

Let us take the stress out of your property purchase, so you can focus on enjoying this exciting milestone. If you’re ready to take the next step in your property journey, get in touch with Almy & Thomas. Our experienced solicitors are here to answer your questions, provide a clear conveyancing quote, and guide you through the entire process.